NVIDIA’s Stock Is Having a Moment. Here's Why.

The artificial intelligence boom is heating up and a big player in the AI space, NVIDIA (NVDA), is leading the chase — making for one of the most historic runs in the stock market recently.

It seems many people watching the market are wondering the same two things: What’s the juice behind this recent rally, and how far will it go?

NVIDIA’s highly anticipated recent earnings report, closing the books in 2023, blew expectations out of the water with $22.1 billion Q4 revenues — up 22% from the previous quarter and up 265% from a year ago.

NVIDIA is one of the top chip manufacturers, producing graphics processing units (GPUs) that are essential for processing the massive amounts of data that makes AI possible.

According to a report published in Feb. 2024 by Yahoo Finance, NVIDIA previously generated most of its revenue from GPUs used for video gaming, but have since expanded into the data center space, consistently manufacturing more powerful GPUs that make it easier to carry out AI tasks.

Some of NVIDIA’s largest customers include Meta Platforms Inc., the parent corporation of Instagram and Facebook, Microsoft Corp., Amazon.com Inc., and Alphabet Inc. (Google), who are responsible for nearly 40% of its revenue, as a 2024 Bloomberg report states. These are just a few of the big names investing in the processing power required to compete in the AI space.

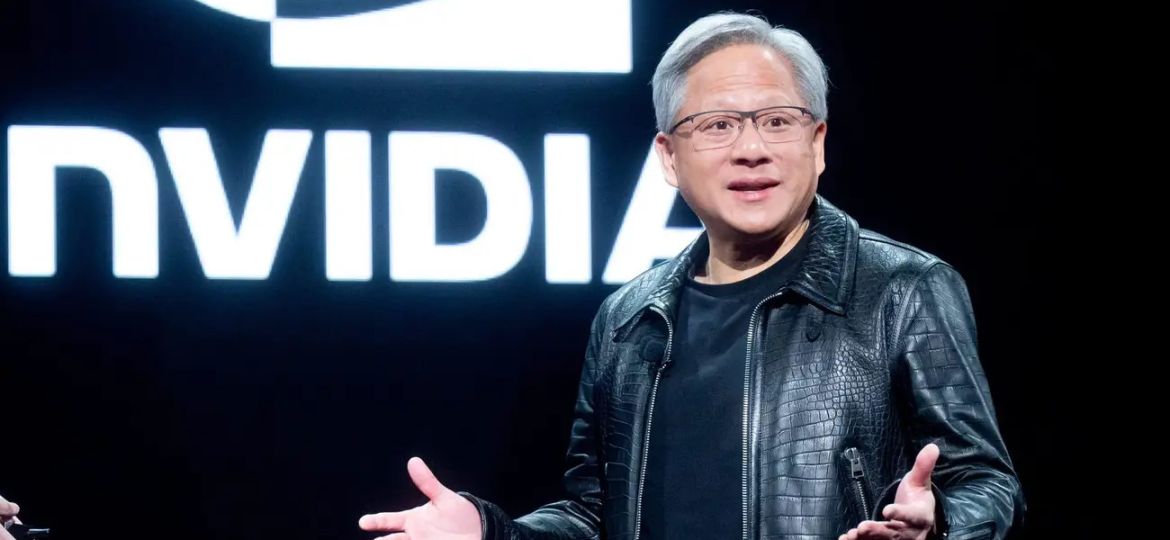

“Demand is surging worldwide across companies, industries and nations,” says NVIDIA founder and CEO, Jensen Huang.

The question many people are asking is this — how long will this demand last?

GPUs are used primarily in the computational phase of building artificial intelligence models, to train the model with an unfathomably large amount of data. Large language models, for example, are deep learning models that, after being trained by vast data sets, can recognize and generate text automating tasks that previously required human intelligence.

As models move into the application phase, known technically as “inference”, live data is run through the now-trained model and the demand for GPUs may taper off, as inference requires less computing power than the intensive training phase.

According to Gene Munster of Deepwater Asset Management, this is where the “bust” could come, in what he refers to as the “boom and bust” semiconductor business. Despite this, he remains bullish on the chip supplier long term, stating that $1,000+ price targets will “prove to be conservative.”

According to Huang, 40% of NVIDIA’s data center revenue is from AI inference, which may put some of these “bust” concerns to rest.

Some economists and market analysts are comparing the rapid increase in AI stock valuations to the dot-com bubble of the late 1990s, but these are not apples to apples. “The infrastructure, or the training of these AI models, aren’t just being built out with investors crossing their fingers,” said Munster in an interview on CNBC’s Fast Money on February 22nd. “We are already seeing adoption, and we are at the very beginning.”

Sure, not all business models are going to pan out, but we don’t yet know what’s going to be a successful business in the AI space. As longtime tech journalist Kara Swisher sees it, when you got the iPhone in 2007, could you have thought of Uber? Probably not. Right now, much of the development in this AI revolution is restricted to the larger players. Not only is the cost of computing extremely high, but it’s the blue-chip companies that have all the data.

As Huang put it on NVIDIA’s Q4 earnings call with CNBC, he expects what is happening in the West will soon be replicated worldwide, with AI generation factories in every industry, in every country and every region. To me, that sounds like incomprehensible room for growth for companies in the AI space, but the onus is on each individual to decide for themselves.

The bottom line question you must ask yourself is — what’s your outlook on the future of artificial intelligence? As history shows, with numerous breakthroughs in innovation like the iPhone in 2007 or the Internet in 1993, you can only predict so much of what’s to come.

Amazing article Tommy!